ENERGY FOR YOUR HOME

Energy Solutions

Harness the Power of Solar to Transform Your Home's Energy Efficiency

Explore Renewable Energy Solutions with Solar

Take control of your energy future with our advanced solar solutions designed to meet your home’s power needs while reducing your carbon footprint. Our solar systems provide sustainable, reliable alternatives to traditional power sources, offering the flexibility to go completely off-grid with full battery backup. Experience true energy autonomy and contribute to a greener planet with our expert guidance on harnessing the sun’s energy to achieve your energy consumption and environmental goals.

Harness the Power of Solar Energy

Harness the power of solar energy to transform your new home into a model of efficiency and sustainability. By choosing the right solar system, you can significantly reduce or even eliminate your reliance on traditional energy sources, paving the way for long-term savings and environmental benefits. Whether you aim to lower your utility bills, ensure backup power during outages, or achieve complete energy independence, taking the time to understand your solar options and energy needs is essential. Follow the steps below to determine the best solar solution for your home, and start your journey towards a greener, more cost-effective future.

Step 1: Determine Your Primary Goal for Going Solar

What System Suits You

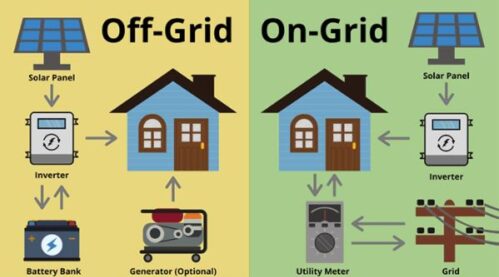

Grid-Tie Solar: Select this option if you will have access to the utility grid and your main goal is to save money on your electric bill.

Grid-Tie Solar + Energy Storage: Choose this if you will have access to the utility grid but want backup power during potential outages.

Off-Grid Solar: Opt for this if you will not have access to the utility grid and plan to live in a location where the grid is not accessible.

Step 2: Estimate Your Power Needs for a New Home

Click the button below to download the PDF: Common Household Appliances and Their Power Usage.

Determine Your Power Requirements

Evaluate Your Planned Energy Consumption: Consider the size of your home, the number of occupants, and the types of appliances and systems you plan to use (e.g., HVAC, water heating, kitchen appliances).

Use Energy Usage Examples: Refer to common energy usage patterns fo homes similar to yours in size and location. You can provide typical usage examples or an energy calculator to help customers estimate.

Plan for Future Expansion: Account for any potential increases in energy use, such as installing electric vehicle chargers or adding more appliances over time.

Step 3: Choose Your Solar Panel Mounting Option

Mounting Options

Roof Mounting: Ideal for homes with sufficient, unobstructed roof space. This is a common choice for saving ground space and enhancing the home’s appearance.

Ground Mounting: Suitable if the roof is not optimal for solar panels due to shading, orientation, or structural concerns. Ground-mounted systems can be positioned for maximum sun exposure.

30% Tax Credit and Get a Quote

Tax Credit Information

Learn more about the 30% Solar Investment Tax Credit (ITC) and how it can benefit you.

Get a Personalized Solar Estimate

Fill out the form below, and Todd will reach out within 24 hours to discuss your needs and provide a tailored solar estimate. Your information will be securely handled by Todd alone, ensuring no unwanted calls or emails.

Understanding the 30% Solar Investment Tax Credit (ITC)

What is the Solar Investment Tax Credit (ITC)?

The Solar Investment Tax Credit (ITC) is a federal incentive that allows you to deduct 30% of the cost of installing a solar energy system from your federal taxes. This tax credit is available for both residential and commercial solar installations, making solar energy more affordable for everyone.

Key Benefits of the ITC

Significant Savings:

Deduct 30% of your solar system installation cost from your federal taxes.

Wide Eligibility:

Applies to both residential and commercial solar systems.

Extended Benefit:

The 30% credit is available for systems installed through 2032.

How It Works

Calculate Your Savings:

- If your solar installation costs $20,000, you can claim a credit of $6,000 (30% of $20,000) on your federal taxes.

Tax Liability:

- You must have sufficient federal tax liability to utilize the credit. If your tax liability is less than the credit amount, you can carry over the unused portion to future tax years.

Eligibility Criteria:

- The solar system must be installed on property you own. It must be operational and used for your personal or business purposes.

Additional Incentives/Important Notes

In addition to the federal ITC, check for state and local incentives that may provide further savings or rebates for your solar installation.

Extension:

The 30% credit rate is available through 2032. Plan your solar installation to take full advantage of this benefit.